Upcoming Online Seminars

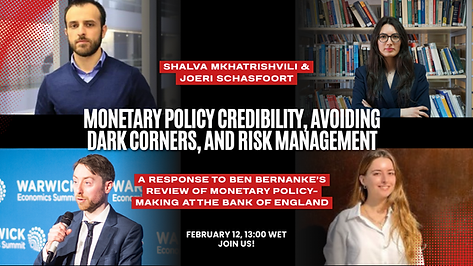

Join us for a seminar discussing the paper “Monetary Policy Credibility, Avoiding Dark Corners, and Risk Management: A Response to Ben Bernanke’s Review of Monetary Policy-Making at the Bank of England”, published in the Oxford Review of Economic Policy.

Douglas Laxton and Shalva Mkhatrishvili will present and discuss the paper, focusing on scenario-based monetary policy, the FPAS framework, and how central banks can manage risks, safeguard credibility, and avoid inflationary “dark corners.”

Read the paper here.

Join us for a seminar featuring two book launches on central banking, risk management, and macroeconomic stability.

The event will introduce Prudent Risk Management Approach to Price Stability: Theory and Practice at the Central Bank of Armenia, edited by Douglas Laxton, Hayk Avetisyan, and Vahe Avagyan, which examines the practical application of risk-based monetary policy frameworks. Learn more here.

The seminar will also discuss The Unanchored Central Banker: Demography, Fiscal Instability, and an Erosion of the Central Bank’s Ability by Manoj Pradhan and Charles Goodhart, exploring the structural forces reshaping monetary policy and central bank independence.