Oil Price Risk Assessment

Oil Prices: A Rollercoaster Ahead?

By The Better Policy Project | September 25, 2025

General Overview

The latest OPRA report suggests that oil markets are entering one of their most unpredictable phases in decades. What makes this moment unusual is not simply the traditional tug-of-war between producers and consumers, but the unusual timing of surpluses and scarcities. The world may first face an oil glut as supply ramps up, followed soon after by shortages that could drive a new cycle of price increases. This duality makes the next five years a period of heightened uncertainty — one where even modest changes in demand or supply could dramatically reshape outcomes.

Short-term: A World Awash in Oil

In the immediate horizon, OPEC+ is reversing its earlier cuts and releasing millions of barrels per day back into the market. With demand growth struggling to keep pace — particularly in advanced economies where energy efficiency and alternative fuels are curbing consumption — this surge in supply is set to push inventories sharply higher. Prices, in turn, are projected to remain within a relatively moderate band of $50–70 per barrel.

This is not unprecedented. The report notes that between 1997 and 2001, the world experienced a similar buildup of inventories. That glut, however, was followed by a sustained period of scarcity and rising prices in the early 2000s. History does not always repeat, but it does offer valuable context: today’s oversupply may sow the seeds for tomorrow’s shortage.

Source: EIA STEO, September 2025

Figure 1. A sizeable supply glut is expected in the coming quarters as OPEC rolls back its production cuts

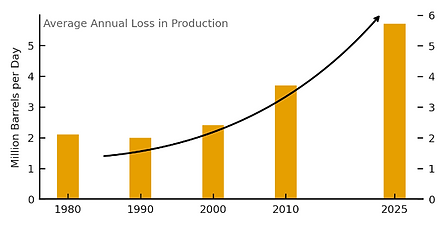

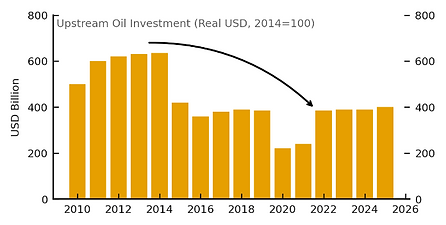

Medium-term: The Treadmill Effect

Looking further ahead, the real risk lies not in oversupply, but in the structural fragility of oil production. Years of underinvestment have left the industry struggling to expand output. At the same time, natural decline rates in existing wells are accelerating. Producers must work harder each year just to sustain current levels, a dynamic known as the “treadmill effect.”

This treadmill effect is particularly stark in U.S. shale fields, where wells can lose up to 30% of their output in the first year. Without continuous drilling of high-quality wells, production slips rapidly. Yet drilling activity has slowed, and the quality of new wells is deteriorating. Meanwhile, traditional producers such as Saudi Arabia also face peak-output challenges. Together, these factors mean that once demand catches up with current production, there will be little spare capacity to cushion the impact.

Figure 2. Decline rates among existing oil wells versus upstream oil investment

Source: EIA STEO, September 2025

Production Paths: Peak or Plateau?

The medium-term outlook hinges heavily on whether leading producers can sustain their peaks. In a high-production scenario, the U.S. and Saudi Arabia are able to hold output at current levels for longer than expected, while other countries such as Venezuela, Iraq, and Argentina contribute incremental gains. This would give the global system a little more breathing space.

The low-production scenario, however, envisions both the U.S. and Saudi Arabia slipping into structural decline by 2027. For the U.S., the fall would be steeper due to the treadmill dynamics of shale oil, while Saudi Arabia’s decline would be more gradual. If both enter decline, the world faces a future of scarcity and heightened price volatility.

Figure 3. US and Saudi Arabia oil production scenarios

Source: EIA, BPP

Consumption Paths: Demand Divergence

On the consumption side, the future splits into two very different stories. In the high-consumption scenario, emerging markets — especially India and sub-Saharan Africa — dominate. With large, youthful populations and still-low per capita oil use, these economies could drive massive new demand growth. For instance, India alone consumes about 10 million barrels per day less than China, despite having a similar population. As incomes rise, the potential for growth is enormous.

In contrast, the low-consumption scenario rests on the accelerated adoption of electric vehicles (EVs), particularly in advanced economies and China. In this case, oil demand in transport — the single largest component — begins to taper off, with declines in developed markets outweighing gains in emerging economies. Here, global oil consumption still grows, but at a much weaker pace.

Figure 4. Europe and China oil consumption scenario

Source: EIA STEO, September 2025

Implications: Uncertainty Is the Only Certainty

For policymakers, the stakes are high. Net oil-importing countries worry about inflation pressures returning if oil prices climb again. For central banks already struggling to bring inflation back to target, another oil shock would be deeply destabilizing. Meanwhile, producers face their own dilemmas — whether to invest aggressively now to expand capacity, or to hold back and risk being caught flat-footed by surging demand.

The report’s key conclusion is sobering: even modest, plausible shifts in either supply or demand could produce vastly different price trajectories. As the early 2000s showed, periods of glut can quickly give way to prolonged scarcity. In the years ahead, vigilance, flexibility, and robust policy frameworks will be essential to navigate what looks to be a rollercoaster ride for oil prices.